Digital Camera Market Shake-Up

News

2019.01.01

Although the market of digital cameras kept declining year over year, 2018 marked the beginning of an industry-wide war over market dominance. Opening moves were made, but this war will certainly span over years.

Reality is that fewer digital cameras are being sold each year. Most market loss occurs at the low-end of the where cellular phones have already replaced nearly all point-and-shoot cameras. Accordingly, the majority of camera makers stopped introducing generic point-and-shoot models, opting to focus on specialized cameras such as ultra-zooms and rugged waterproof ones. On the opposite end of the spectrum, market penetration reached a point where the majority of enthusiasts already own sufficiently well-performing cameras, often more than one. This happens in all new markets where adoption creates rapid growth until a saturation point and more significant advances are necessary to convince current owners to upgrade.

In order to stay afloat, camera manufacturers have sharply increased their average selling price to compensate for lower sales volume. This makes further adoption and upgrades harder to justify, particularly when considering vendor lock-in of all platforms except Micro Four-Thirds which is shared between Panasonic and Olympus. This situation forces camera makers to innovate more quickly to get harder-to-win customers. This is very good for advancement of camera technology!

The Battleground

To understand the various moves made in 2018, it is best to recap the situation and position of each major manufacturer.

Canon

As one of three dominant players in the industry, Canon is extremely solidly established. Its system of APS-C and Full-Frame DSLRs sell extremely well from entry-level units to the highest level required by professionals. Their EF-mount, shared between APS-C and Full-Frame DSLRs, is decades old with over a hundred million lenses manufactured! This provides them with the strongest vendor lock-in among brands.

In late 2012, Canon introduced a new incompatible EF-M mount for a series of APS-C mirrorless cameras. While capable, reception has been generally weak. People have always considered Canon late-to-market as its cameras were comparable to those produced a few years earlier by other makers. Only a handful of lenses were available for a long time. Being APS-C only, this system left no upgrade path and was never intended for professionals to which Canon sells Full-Frame DSLRs.

Fujifilm

Although Fujifilm produced some highly-successful DSLRs that were based on the Nikon platform, they did not have their own platform to protect. So, Fujifilm took the market by storm doing exactly the opposite as everyone else. Their first mirrorless digital camera was aimed squarely at the high-end market and launched with matching high-end optics and an aggressive lens roadmap which they have been keeping up very well with. Fujifilm choose an APS-C sensor to offer a substantial size advance over other high-end cameras which were all full-frame at that point.

As Fujifilm claimed to be capable of matching the image-quality of a full-frame sensor using APS-C sensors using their X-Trans technology that does not need an anti-alias filter to prevent moire artifacts, they keep producing high-end cameras built around an APS-C sensor. This only takes them so far while other manufacturers improve their Full-Frame sensors. Avoiding direct competition, Fujifilm fired back with a mirrorless Medium-Format platform. Size being the trump card of image-quality, this immediately gifted them top image-quality among digital cameras, matching a handful of existing Medium-Format offerings by Pentax and Hasselblad.

Nikon

The other market giant from the film era, Nikon, landed roughly the same situation as Canon. They offer everything from entry to high-end professional DSLRs based on their own Nikon F-mount which is shared among the entire lineup. Entry-level DSLRs use APS-C sensors, while professional ones use APS-C or Full-Frame ones, although mostly the latter for obvious performance reasons.

A year before Canon introduced their mirrorless system, Nikon tried the same but made sure its system could no compete with any DSLRs by basing it around a much smaller 1" sensor. These cameras have a 2.7X crop, which results in a smaller than Four-Thirds sensor. Nikon produced the unique 1 AW1 pictured above, the only waterproof mirrorless digital camera ever made. Still, a system with such smaller is hard to justify.

Olympus & Panasonic

Following each other alphabetically is purely coincidental for the two manufacturers that launched the mirrorless revolution. They did have DSLRs years ago but these two companies completely shifted to a mirrorless lineup long before anyone else.

The Micro Four-Thirds platform shared by Olympus and Panasonic is based around 2X crop sensor which is smaller than APS-C. Conceding right from the start on image-quality, the promise is to deliver a much smaller form-factor than any DSLR can. A significant part of the market was exactly asking for this. Compact image-quality was too low, DSLRs were too large, so people asked for a compromise between the two which Micro Four-Thirds fulfilled extremely well.

As the original system and one that is joint between two companies, Micro Four-Thirds enjoys having the most developed and extensive lineup of native lenses. Most of these lenses are quite smaller even than equivalents for APS-C cameras, mirrorless or not.

Pentax

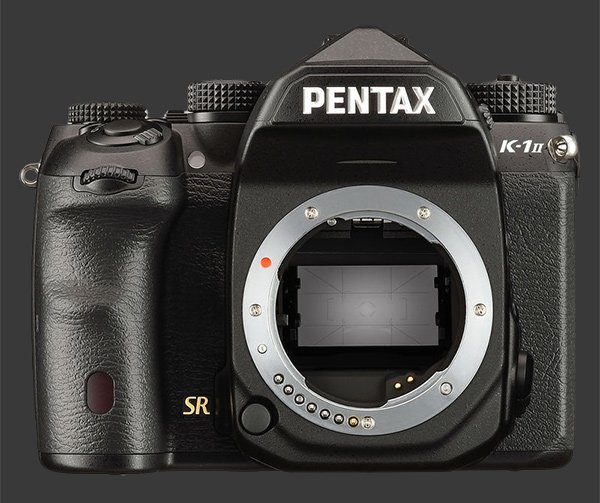

Historically a significant player in the film camera market, Pentax struggled to keep its leadership position in the digital world. Being a smaller company, Pentax substantially relies on external providers. This makes innovation much harder. Even so, Pentax produces some of the very best APS-C DSLRs on the market, boasting many first and unique features.

Not having a Full-Frame offering for a very long time, many prospective buyers worried about lacking an upgrade path. When the K-1 was released, the first Full-Frame K-mount DSLR, many people who saw full-frame as necessary had already moved on. An earlier launch would have made a world of difference, given that Pentax has the oldest lens-mount in use among mainstream digital cameras. Due to their limited resources, Pentax has been introducing fewer new lenses than other manufacturers.

Pentax tried unsuccessfully twice to enter the mirrorless market. Once with their K-01 which was really a crippled DSLR with new viewfinder, poor ergonomics and no size advantage. Again the tiny Q system that sported the smallest sensor ever used in a mirrorless camera. It could not deliver on image-quality.

Sony

When Sony acquired Konica-Minolta, the electronics giant obtained the most advanced digital cameras on the market plus an incredible history of photography intelectual property and talent, including Minolta optics manufacturing which had merged with Konica several years earlier. Minolta invented sensor-shift stabilization which made its way onto their highly-acclaimed APS-C DSLRs based on the A-mount which Sony adopted, instantly inheriting a huge lineup of existing lenses and an already sizable customer-base.

Starting off with an existing mount with a long history gave Sony a stepping stone to take on Canon and Nikon who both held much larger market share than Konica-Minolta. The DSLR mount was then used in their innovative SLT cameras which were hybrids between SLRs and Mirrorless but essentially worked as the later. They later introduced the shorter E-mount in a way that A-mount lenses could easily be adapted without loss of quality and performance. Given that no A-mount lens was stabilized, the in-body stabilization unique to Sony at the time gave them a critical advantage.

Sony's entrance into the digital camera market caused a dramatic shift due to their status as one of the largest electronic manufacturers in the world. Cameras used more and more technologies which need to keep advancing in order to improve performance and Sony is one of the few that can produce high-quality sensors, already supplying Nikon and Pentax with sensors for a while and then Olympus and Panasonic. Some of Sony sensors are even used by Canon, who is the other major company that can produce sensors for DSLRs. A handful of other makes exist and have been used in DSLRs and mirrorless cameras from major manufacturers, but those all have had limited success.

Sony is truly the undisputed king of miniaturization. Their Alpha series of APS-C mirrorless cameras are just as small as Micro Four-Thirds and their Full-Frame mirrorless comparable in size to mid-to-upper-range Fujifilm APS-C models. This gives than an immediate image-quality advance within a certain form-factor. Of course, optics have cannot be made that much smaller, so overall a Micro Four-Thirds system with 3-5 lenses saves quite some volume when compared to an equivalent APS-C from Sony. With just one lens though, the difference is not that much.

Opening Moves

Without a doubt, the war ahead is about mirrorless market share dominance and survival. Point-and-shoot cameras have already lost to cellphones and there is no system which keeps users without a brand, so we expect a handful of compact to be renewed everywhere with increasingly new features that are unfeasible for phones. The Premium Compact market in particular has been expanding with now Sony, Canon, Panasonic and Fujifilm all offering compelling models.

There cannot be a DSLR war because it would be winnable. Canon and Nikon are expected to split the market share that will slowly dwindle as photographers migrate towards mirrorless. The only one fighting for survival among DSLR manufacturers is Pentax and their prospects are bleak. Their flagship K-1 Mark II is one of the best DSLRs on the market and packs many innovative and unique features. The sad reality is that a great DSLR cannot save a system. Pentax under Ricoh ownership has been stagnant when it comes to lens production with pedestrian offerings when even the majority are not their own design. As it stands, the system is limited and also gets reduced support from third-party lens makers. They have a couple of APS-C DSLRs too, also great performers, that deliver great features, excellent ergonomics and truly robust weatherproof bodies, yet they suffer from the lack of lenses too. Many previously excellent Pentax optics just do not stand up against the competition anymore.

Mirrorless is the future of photography. The live-sensor feed opens up so many possibilities that DSLR cannot realize that those already outweigh the majority of DSLR advantages. A DSLR with always have significantly longer battery-life, faster AF - although not as accurate - and allow framing even when powered off. The new EVFs are so sharp and bright that they make framing easier than OVF in most situations now. Their ability to preview exposure, so far only truly mastered by Sony and Canon, makes photography much easier.

While the exiting battleground was easy enough to understand alphabetically, it is easy to understand what is brewing in a different order:

Olympus

As the longest established player in the mirrorless arena - along with Panasonic - Olympus is holding its current strategy. Their Micro Four-Thirds mirrorless cameras benefit from the largest native mirrorless lineup of the industry. All their cameras are stabilized and so any lens from themselves, Panasonic or third-party makers get the benefit.

Olympus finds themselves with a comfortable market share yet their position makes it difficult to expand. As mentioned earlier, they currently use the smallest sensors among actively developed mirrorless systems. Image quality is certainly good, yet a current larger sensor is always capable of performing better. This leaves them to keep fight on size, producing small cameras and continuing to make their lenses as small as possible.

There are two threats to Olympus market share. One is Panasonic which is their direct competitor since they also build mirrorless cameras with Micro Four-Thirds sensors. Panasonic has been gradually adding built-in image-stabilization to match Olympus capabilities in all but their smallest models. The system is the same, so there is no significant cost when switching between Olympus and Panasonic.

The second comes from Sony. As their APS-C cameras have virtually matched the compactness of Micro Four-Thirds cameras, the difference in bulk is rather small while image quality is always higher.

Panasonic

Panasonic finished 2018 in exactly the same position as Olympus. They have a strong and well-established hold onto the mirrorless market thanks to the joint Micro Four-Thirds system shared with Olympus. Oddly, there are quite a number of companies in the consortium, including Fujifilm, yet no other has made a noticeable contribution o the the system.

The threats to Panasonic market share are the same as for Olympus, yet the Panasonic response is entirely different. Panasonic is a much larger company and one which can compete better with Sony, although they adopted Sony sensors several years ago to bridge the gap in image-quality.

In September 2018 at Photokina, Panasonic announced the development of a pair of professional Full-Frame Mirrorless Digital Cameras. These are slated to hit the market in mid-2019 and represent a surprising and direct move to grab market-place from Sony, who has enjoyed being the only full-frame mirrorless camera maker until the end of 2018.

Understanding well the value of an established system, Panasonic decided to share the Leica L-mount platform and use it for their new full-frame system. This instantly gives them access to an existing lineup of premium Leica lenses which is expected to speed up adoption. Panasonic will also introduce their own set of lenses with 3 pre-announced, a 24-70mm, 70-200mm and 50mm prime.

jumping straight to full-frame from Micro Four-Thirds means that all market share Panasonic expects to get is going to be new. The new 48 MP S1R and 24 MP S1 are much larger than existing Panasonic mirrorless and so cannot canibalize their own market share. Like Fujifilm, this gives them two non-competing lineups. The principal audience of these new cameras are users of Sony full-frame mirrorless or users of Canon and Nikon DSLRs ready to switch systems.

Sony

As the first one with Full-Frame Mirrorless cameras, Sony took the first-mover advantage. Their production capacity and talented optical engineers acquired by Konica-Minolta plus a strategic partnership with world-renowned Carl Zeiss, allowed Sony to consistently produce superb high-quality lenses at an unmatched pace. They have created themselves such an incredible lead that they are now the number one full-frame camera maker, outselling Full-Frame DSLRs from Canon, Nikon and Pentax.

Sony knows this is where the battle is an they kept introducing better and more advanced full-frame mirrorless cameras at the expense of neglecting their APS-C series that was last updated in 2016. Expect a new APS-C mirrorless from Sony very soon then! They have to produce one to keep their market share among those not ready to spend on a full-frame and the necessary matching lenses. One full-frame was introduced in 2018 and two in 2017, so they will probably add another 2 this year.

The main point for Sony is that they are already on the winning track. They do not need to change their strategy, just keep up innovation to hold on to their position.

Pentax

The Pentax brand is clearly in a tough spot. Their DSLR sales are eroding due to the lack of new products, both in terms of cameras and lenses. Plus, the market is generally moving away from DSLRs as mirrorless cameras become more capable. So, despite consistently producing some of the best performing and most feature-rich cameras on the market, their digital camera market share is expected to be on a steady decline. Fewer sales gets fewer income which makes it increasingly difficult to innovate. Pentax is at risk of disappearing within a few years.

As far as people know, Pentax does not have a mirrorless strategy. They can play at holding the DSLR fort when the big two stop producing DSLRs but it is doubtful that Pentax will last that long. While the K-01 itself was poorly executed, making a K-mount mirrorless is their best shot at survival. It would look different than its competitors because it would have a deep collar to mount of lens on but it should not add depth to the camera since it the K-mount never reaches the thickness of the camera grip. This would at least let Pentax use their existing lineup because they would not be able to build enough lenses sufficiently quickly for a new platform.

Canon

Right at the end of 2018, Canon introduced their entirely new RF platform. It started with a single mid-range Full-Frame Mirrorless Camera built around their unique Dual-Pixel CMOS technology and a new short-flange RF lens mount. Four lenses were introduced along with the camera, including the brightest full-frame zoom ever made. While the camera itself is nothing ground-breaking, Canon is certainly capable of creating a large ecosystem for professionals while also refining their existing DSLR lineup.

Success of the RF system is not guaranteed since, once a new platform is offered, customers are likely to consider all available platforms that suit their needs. By mid-2019, there will be four Full-Frame systems and even two Medium Format ones, Hasselblad and Fujifilm, for professional to consider. Fujfilm in particular will be at their third offering with 7 lenses already in production and a few more announced.

What Canon therefore must do is produce cameras and lenses that deliver performance that at least closely matches the competition around the same price-point. Their mid-range start is not intended for professionals yet is a good offering to show the direction of the platform. The most significant short-coming of the new Canon EOS R is that it is the only current full-frame mirrorless camera without image stabilization, although nothing prevents future models from including it.

Nikon

At Photokina 2018, beating Canon by a hair, Nikon unveiled a completely new Full-Frame mirrorless platform based on an ultra-short and wide all-electronic lens mount optimized for image-quality. The new Z-mount is a complete redesign to start a new era of Nikon mirrorless digital cameras.

The launch lineup includes a pair of nearly identical Full-Frame Mirrorless Digital Cameras, the 46 megapixels Nikon Z7 reviewed here and the 24 megapixels Z6. The announcement came with three lenses, concentrating on lighter-weight offerings than Canon but resulting in exactly 5 new mirrorless produces launched by each brand. Nikon also announced at the same time the development of their Z 50mm F/0.95 Noct lens to boldly state the light-gathering capabilities of their new Z-mount.

Nikon made their new mirrorless cameras very polished, aiming both at professionals with each offering a different balance between resolution and speed. The 46 MP model shoots at 9 FPS, while the 24 MP one shoots at 12 FPS. The larger pixels of the Z6 make its sensitivity range shifted by one stop, so it is ISO 50-204800 at 24 MP or ISO 32-102400 at 46 MP. Nikon gave their new cameras with a 5-axis image-stabilization which also supports Dual IS when a stabilized Nikon F-mount lens is adapted. Both the Z7 and Z6 bodies are highly weatherproof too, although neither is freezeproof at models from Pentax and Fujifilm.

Nikon is almost equally capable as Canon to deliver and grow a new mirrorless platform. They even announced an aggressive roadmap of upcoming lens that include some very interesting offerings that are expected to take fully advantage of mirrorless capabilities. Nikon does rely on Sony sensors for most of their cameras which has worked well for them and makes sure they cannot fall behind on image-quality.

The Year to Come

2019 is certain to be one of the most exciting year in digital camera history. With three entirely new platforms in the market, the battle will be fierce. Panasonic stated they are aiming right at the professional market and if Canon produces a high-end mode, something it is extremely likely to do, all four systems will be in direct competition. Sony already has the lead due to their extensive lens lineup and being the sensor source for most other makers and Panasonic is playing the L-mount card in an attempt to leapfrog Canon and Nikon, which just might work. Remember, when Olympus and Panasonic had first moving advantage in the mid-range market, no one managed to displace them despite numerous attempts.

Of course, the market is not all high-end. That is just where the next battle is happening since those cameras are the most expensive and lucrative. Professionals upgrade much more often to maintain their edge and keep up with increasingly demanding clients. At entry-level of the mirrorless market, Olympus and Panasonic are pretty much assured to split the majority of the market between them. Sony has a chance to take a fraction of that market if they introduce new APS-C mirrorless cameras.

Fujifilm is strategically placed to get the enthusiast market and the ultra-high-end one, slotting themselves between the Micro Four-Thirds camp and the four full-frame systems of 2019, plus being one of only two to offer Medium Format mirrorless cameras. The key is that they most keep innovating to prevent the level below from catching up. The gap between full-frame and medium format is rather small, compared to between APS-C and Full-Frame.

The downside of having all these new systems on offer is the incertitude of which one will survive, expand and keep delivering to satisfy the needs of its users. Interesting times are right ahead!

- Digital Camera

Please Support Neocamera

All information on Neocamera is provided free of charge yet running this website is a huge endeavor. Purchases made via affiliate links found throughout the site help keep it running and up-to-date. There is no additional cost to you, so please consider buying via these links to our affilates:

If you found any information on this site valuable and did not purchase via our affiliate links, please considering donating via PayPal:

Any amount will be greatly appreaciated. Thank you for your support!

New Cameras & Lenses

Canon RF-S 14-30mm F/4-6.3 IS STM PZ

Stabilization

Canon RF Mount Zoom

2025-03-26

Canon RF 20mm F/1.4L VCM

Weatherproof

Canon RF Mount Prime Lens

2025-03-26

Canon EOS R50 V

24 Megapixels Mirrorless

Canon RF Lens Mount

2025-03-26

Venus Optics Laowa 14mm T/2.6 Zero-D VV Cine

Sony E Mount Prime Lens

2025-03-25

Venus Optics Laowa 14mm T/2.6 Zero-D VV Cine

Nikon Z Mount Prime Lens

2025-03-25

Venus Optics Laowa 14mm T/2.6 Zero-D VV Cine

Leica L Mount Prime Lens

2025-03-25

Updates

2025.01.18

Fujifilm GFX 2025 Lens Roundup

Lens Review roundup of Fujifilm GFX Medium-Format lenses. Quality, performance and handling of the GF20-35mm F/4R WR, GF30mm F/3.5 Tilt-Shift and the GF55mm F/1.7.

2024.11.18

Best 2024 Photography Gifts for Every Budget

Great gifts for photographers and photo enthusiasts selected for every budget among the best products of 2024.

2024.08.07

Eye Protection Tips for Professional Photographers

The four main considerations for professional photographers regarding eyewear.

2024.07.14

Fujifilm X100VI Review

Flagship fixed-lens compact digital camera with a 40 MP sensor and Image-Stabilization, a first for the series. Retro design featuring dual control-dials, plus direct ISO, Shutter-Speed and EC dials. Its hybrid viewfinder can switch between EVF and OVF mode.

2024.05.09

Fujifilm GFX100 II Review

Flagship 102 Megapixels Medium-Format Mirrorless Digital Camera with 8-Stop 5-Axis IBIS, 8 FPS Drive, 8K Video and 400 MP Super-Resolution capture in a weatherproof and freezeproof body with dual control-dials and dual memory-card slots.

2024.04.03

Fujifilm X-T5 Review

Newest Fujifilm flagship boasting a 40 MP APS-C sensor, 5-axis IBIS with 7-stop efficiency, 15 FPS continuous drive, 6.2K Video capture, dual control-dials and dual SDXC UHS-II slots in a sturdy weatherproof and freezeproof body.

2023.11.20

Best Digital Cameras of 2023

Find out which are the Best Digital Cameras of 2023. All the new Mirrorless Digital Cameras from entry-level to high-end professional.

2023.07.10

Fujifilm X-H2 Review

40 Megapixels APS-C Hybrid Mirrorless Digital Camera with 7-stop IBIS. Fastest shutter ever and 8K video capture. Large builtin EVF with 0.8X magnification and 5.8 MP, plus an Eye-Start Sensor. Packed with features and large number of controls in a weatherproof and freezeproof body.

2023.05.07

Sony FE 20-70mm F/4G Review

Review of the unique Sony FE 20-70mm F/4G lens. The optical zoom of this lens spans ultra-wide-angle and medium focal-length coverage, making it one of the most versatile Full-Frame lenses on the market.

2023.01.15

Huion Inspiroy Dial 2 Review

Review of the Huion Inspiroy Dial 2 tablet, a medium sized drawing surface with dual dials and customizable buttons. Connects via USB-C or Bluetooth 5.0 with Windows, Linux and Android support.

2022.12.08

How to Pack for a Photo Trip

Find out how to pack for a travel photography trip, carry your gear safely while meeting airline regulations.

2022.11.13

Best Digital Cameras of 2022

The best digital cameras of 2022. A short list of the most outstanding models in their respective categories. Choose one for yourself or as a gift.